Asian stocks fell on Wednesday after lacklustre earnings from U.S. tech behemoths Tesla (NASDAQ:TSLA) and Alphabet (NASDAQ:GOOGL) dented risk appetite, while the yen surged to a seven-week high ahead of a central bank meeting next week where a rate hike remains on the table.

The U.S. dollar was broadly steady, with traders watching out for an inflation reading on Friday and Federal Reserve meeting next week. The Bank of Japan is also due to meet next week, where a 10 basis point hike is priced at a 44% chance. [FRX/]

MSCI's broadest index of Asia-Pacific shares outside Japan was 0.35% lower, while Japan's Nikkei fell 1%. Taiwan financial markets are closed due to a typhoon.

Nasdaq futures slid 1%, while S&P 500 futures were 0.6% lower after Tesla reported its smallest profit margin in more than five years, weighing on other EV stocks.

Shares of Google-parent Alphabet slipped in after-hours trade even as the firm beat revenue and profit targets.

"The bar was set so high for Alphabet that a modest earnings beat couldn't push the stock higher. So, the market has no news to buy into," said Kyle Rodda, senior financial market analyst at Capital.com.

"It also speaks to concerns that tech stocks are too richly valued here. We will have to see how the other tech giants report and how the markets react."

The dour mood is set to move to Europe, with Eurostoxx 50 futures down 0.65%, German DAX futures down 0.44% and FTSE futures 0.3% lower ahead of a slew of earnings from companies in the region.

Investor focus will be on European luxury stocks after the world's biggest luxury group LVMH reported slowing sales growth as Chinese shoppers lower their spending.

Chinese stocks were subdued in choppy trading, with the Shanghai Composite index flat, while the blue-chip CSI300 index was 0.26% lower after recording its largest one-day decline since mid-January on Tuesday.

On the macro side, investors await U.S. GDP data on Thursday and PCE data - the Fed's favoured measure of inflation - on Friday to gauge the expectations of interest rate cuts this year.

Markets are pricing in 62 basis points of easing this year, with a cut in September priced in at 95%, the CME FedWatch tool showed.

A growing majority of economists in a Reuters poll said the Fed will likely cut rates just twice this year, in September and December, as resilient U.S. consumer demand warrants a cautious approach despite easing inflation.

"The U.S. consumer has remained extremely strong ... but you're starting to see a degree of fragility underlying some of the data," said Luke Browne, head of asset allocation for Asia at Manulife Investment Management.

YEN RIDE

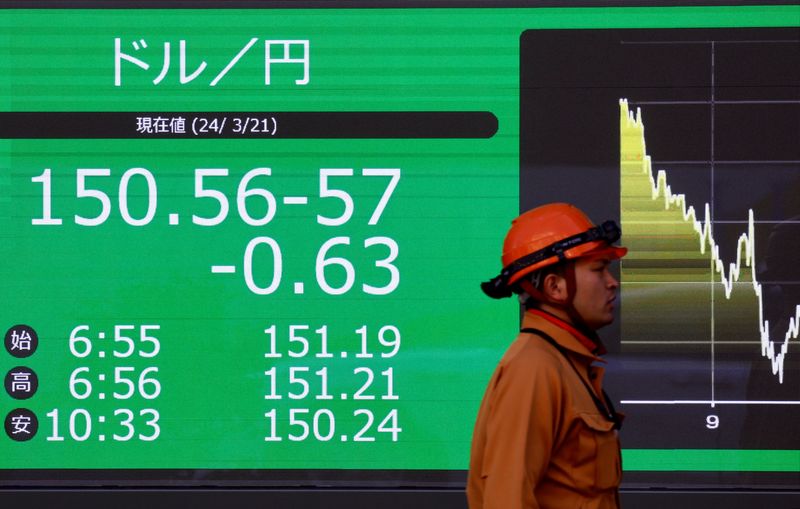

The Japanese yen spiked to its highest in seven weeks of 154.36 per dollar after surging nearly 1% on Tuesday, having languished near a 38-year low of 161.96 at the start of the month. It was last up 0.56% at 154.75.

Traders suspect Tokyo intervened in the currency market in early July to yank the yen away from those lows, with estimates from BOJ data indicating authorities may have spent roughly 6 trillion yen ($38.62 billion) to prop up the frail currency.

The bouts of intervention have led speculators to unwind popular and profitable carry trades, in which traders borrow the yen at low rates to invest in dollar-priced assets for a higher return.

The yen was broadly higher, with the Japanese unit touching more than a one-month high against the pound, the euro and a two-month high against the Australian dollar. [AUD/]

The dollar index, which measures the U.S. currency against six rivals, was little changed at 104.41. The index is down 1.3% this month.

In commodities, oil prices rose on easing U.S. crude inventories. Brent crude futures for September rose 0.28% to $81.24 a barrel, while U.S. West Texas Intermediate crude for September gained 031% to $77.2per barrel.

($1 = 155.3600 yen)